us exit tax green card

Citizenship and Immigration Services USCIS issued you a. Green Card Holders filing US Tax return for the First time.

Green Card Holder Exit Tax 8 Year Abandonment Rule New

The mark-to-market tax does not apply to the following.

. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US. Removing country limits for Green Cards will drastically reduce waiting time for those in queue mostly from India and China and protect them from exploitative employers but. By giving up citizenship they become expatriates under the IRC.

If you make the election to be a nonresident of the United States for income tax purposes you risk triggering the exit tax. It seeks to remove the 7 per country-cap on employment-based green cards in a phased manner. Giving Up a Green Card.

In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or. Exit tax is a term used to describe the tax liability incurred by a person or organization when they leave a country. You generally have this status if the US.

If you are neither of the two you dont have to worry about the exit tax. This is known as the green card test. For 2019 the net gain that you otherwise must include in your income is reduced but not below zero by 725000.

For Green Card holders to be subject to the exit tax they must have been a lawful permanent resident of the Unites States in at least 8 taxable years during a period of 15 taxable. If the taxpayer has a lot of foreign income for the year and arrives in the second half of the year a dual-status return part-year. A long-term resident is defined as.

Citizens of the United States trigger the exit tax rules when they voluntarily or involuntarily terminate that status. Is there an exit tax in the US. Your risk exists if.

The IRS Green Card Exit Tax 8 Years rules involving US. Not everyone is taxed as they leave. Green card holders are also.

The expatriation tax rule only applies to US. Long-term residents lawful permanent residents of the United States holders of a green card visa who terminate that status after holding it for. Filing a US Tax return for the 1st time can be very challenging as various scenarios need to be considered based on the arrival date of the taxpayer.

Someone who is a US. Citizens or long-term residents. Exit Tax is a tax paid on a percentage of the assets that someone who is renouncing their US citizenship holds at the time that they renounce them.

After the phase-in period of nine years employment based green cards will be issued on a first-come. You are a long-term resident. Only green card holders are taxed.

Citizens who have renounced their. Giving Up a Green Card US Exit Tax. When a US person gives up their green card it can be a very complicated ordeal from an IRS tax perspective.

For many Legal Permanent Residents once they learn about the IRS tax liabilities for being a Green Card Holder along with the potential. You are a lawful permanent resident of the United States at any time if you have been given the privilege according to the immigration laws of residing permanently in the United States as an immigrant. The IRS requires certain expats to calculate an exit tax when they exit the US and file their 10401040NR tax return along with Form 8854.

Taxpayer because of spending too many days in the United States can. Exit tax applies to United States.

U S Expatriation Would You Be Considered A Covered Expatriate And Subject To The Punitive Exit Tax Tax And Legal Blog

Reverse Immigration How Irs Taxes Giving Up Green Cards

Once You Renounce Your Us Citizenship You Can Never Go Back

![]()

Japan S Exit Tax Sme Japan Business In Japan

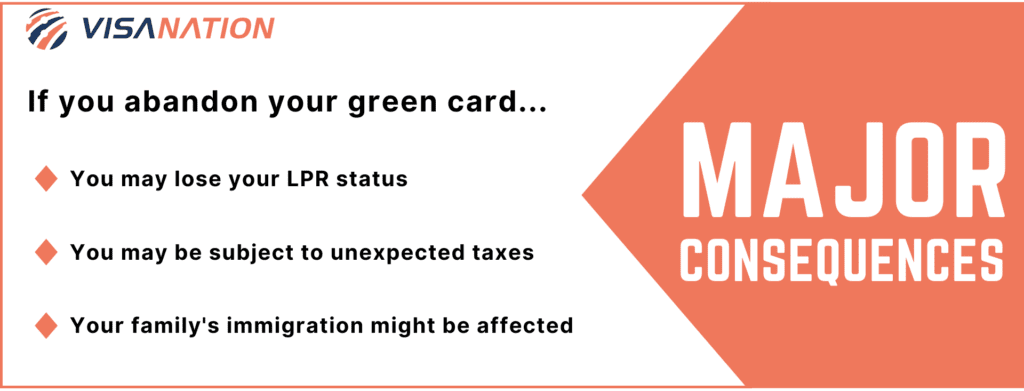

3 Green Card Abandonment Consequences Ways To Reinstate

Green Card Holders Staying Abroad Over 6 Months Risk Abandonment

Green Card Holders Staying Abroad Over 6 Months Risk Abandonment

Indian Citizenship For Us Born Child Benefits Problems Usa

Exit Tax For Long Term Permanent Residents Blick Rothenberg

U S Expatriation Tax Implications Of Renouncing U S Citizenship Or Surrendering A Green Card Abitos Cpas And Advisors

Citizenship Based Taxation Who S Tried It Why The Us Can T Quit

Part 4 You Are A Covered Expatriate How The Exit Tax Is Actually Calculated U S Citizens And Green Card Holders Residing In Canada And Abroad

Green Card Exit Tax 8 Years Long Term Residents Expatriation Permanent Residents Us Exit Tax Youtube

Exit Tax In The Us Everything You Need To Know If You Re Moving

What Is A Resident Alien H R Block

Us Exit Taxes The Price Of Renouncing Your Citizenship

Basics Of Us Exit Tax 1 Taxation For Green Cardholders Navigating Cross Border Lifestyle Youtube

Cross Border Taxes A Complete Guide To Filing Taxes As An American In Canada Carl Cori 9781722980634 Amazon Com Books